Mastering your money:

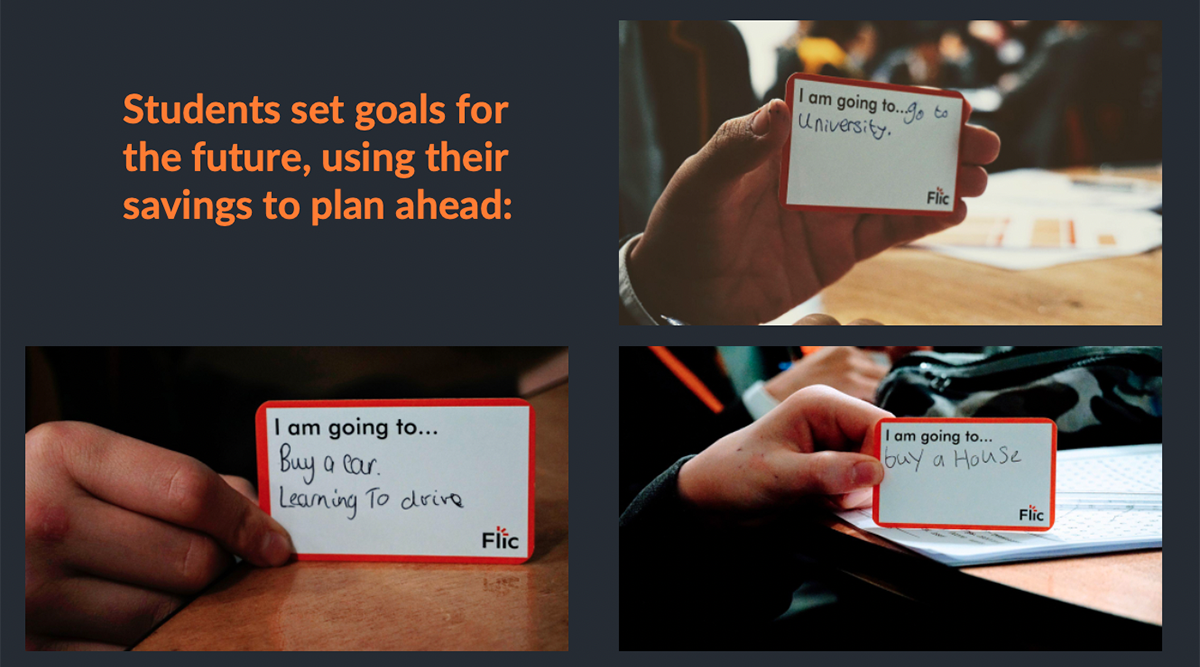

FLIC delivered its first full-blown training session for 200 15 and 16-year-old students at Manchester Enterprise Academy (MEA) in December 2021. The workshop, focused on budgeting and entitled How not to run out of money, forms the basis of the first of our Mastering Your Money modules aimed at 16–25 year olds. We wanted to test the content with a view to using this budgeting module and the seven-module Mastering Your Money programme to upskill PSHE teachers across the UK. The aim of the workshop was for students leave with an appreciation of the importance of budgeting and the confidence to build their own budget that helps them plan for the future they want, whether that was going to university, buying a car or even buying a house.

The setting

MEA is in a poorer neighbourhood of Manchester, and has a large majority of minority ethnic students. Of the more than 200 students we engaged with, 40% receive free school meals. This setting was ideal for a FLIC pilot. As a ‘free school’, independent of the rigidity of the national curriculum, it can take its own line on how it teaches both academic subjects and life skills like financial literacy. The school holds ’cultural capital’ days. It was as part of one of these that FLIC hosted its pilot training sessions, with resources tailored to the students’ career-focused goals. Building on learnings from our initial research and development workshop in September, we developed the school’s PSHE delivery and analysed findings across a sample group.

The workshop

The students gathered in the school’s theatre space to hear from five FLIC volunteers, a personal finance influencer and ex-maths teacher of 9 years, Charlotte Jessop. Charlotte makes a living from an Instagram account called Looking After Your Pennies and worked with PSHE teachers and form tutors to motivate all 200 students. She understands both the challenges of inspiring maths-anxious teachers and the need to make resources bitesize for social media. To help ease the process, Charlotte had access to a range of resources to help run the workshop, including a slidedeck, lesson plan, activities and games.

Impact evaluation tools

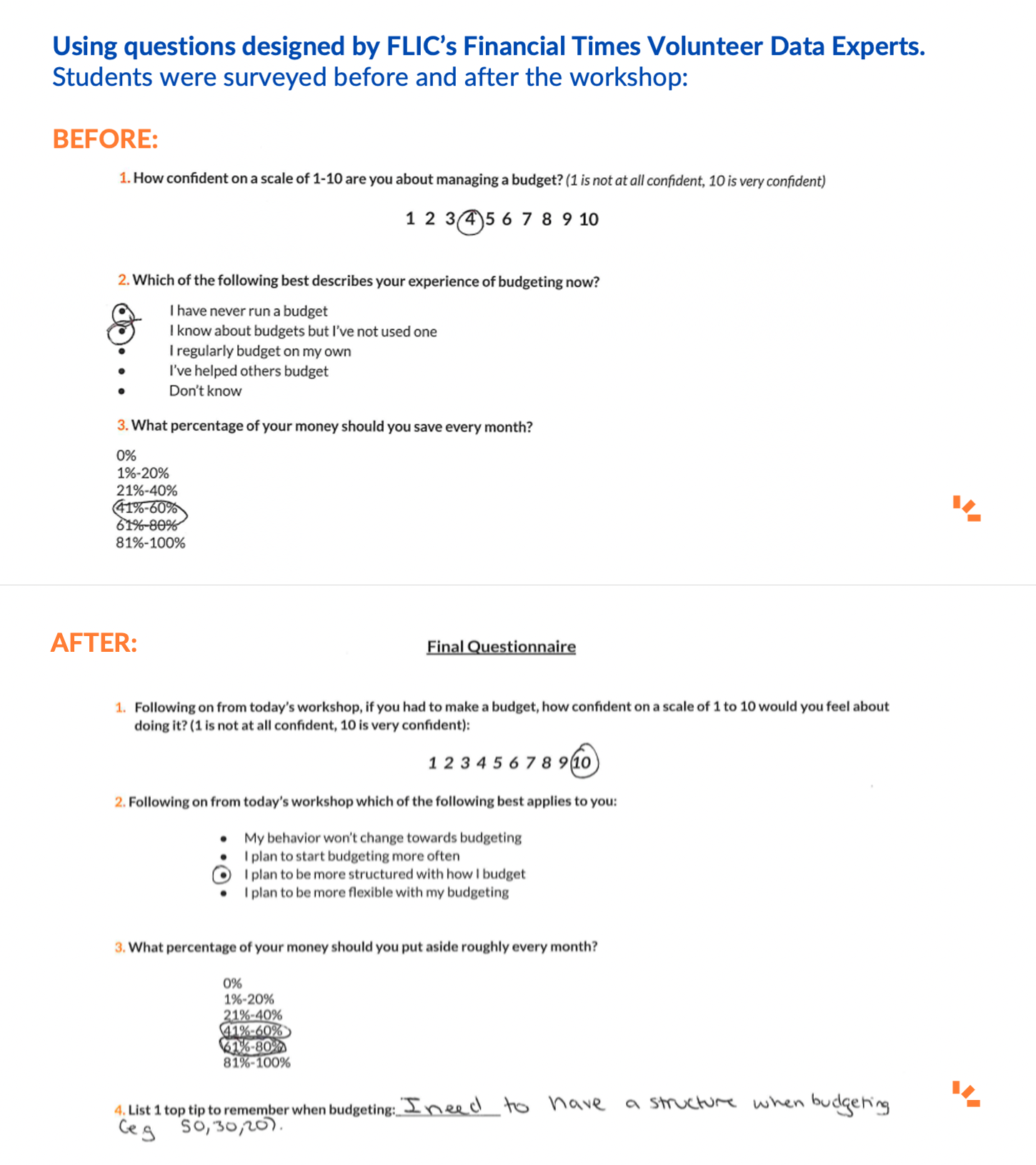

Along with the above resources, Charlotte was provided with a pre-course quiz for the students, teacher interviews and qualitative interviews and videos were used to measure the impact of the workshop, backed up a series of student questionnaires. Some 200 students were surveyed before and after the workshop using questions designed by FLIC’s Financial Times volunteer data experts.

Results

The success of the day was apparent, but a qualitative approach was needed. After analysing the results of the day, we found positive differences in the students’ self-reported confidence, skills and attitudes.

Confidence is up

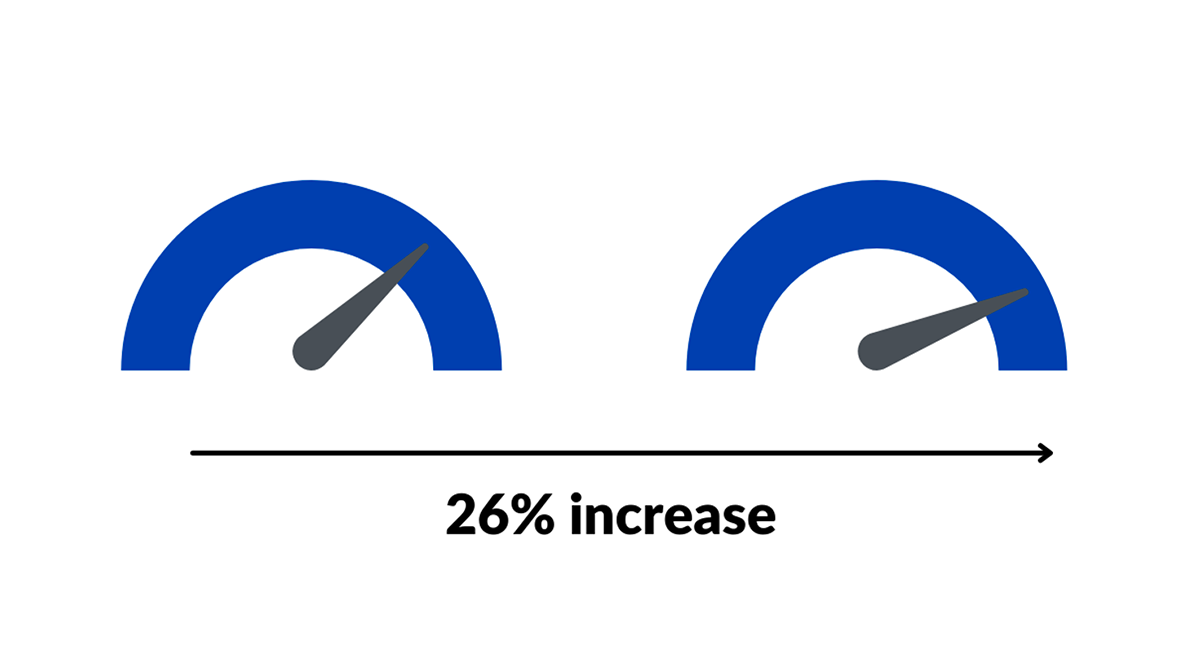

The students were significantly more confident in their ability to budget after the session. Before the session, their average confidence score was 6.6 on a 1-10 scale. After it, their average confidence score was 8.3.

Budgeting skills

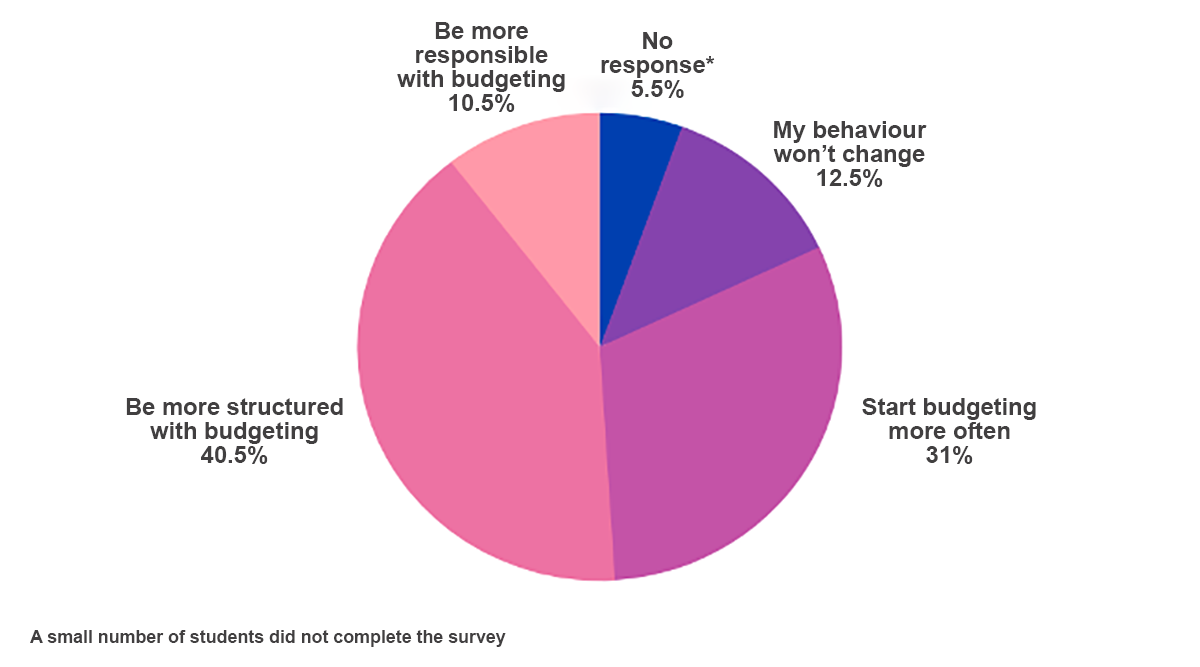

More than 8 in 10 students that took part said they would change their approach to budgeting.

Attitude to spending vs saving

There was a 37% increase in the proportion of students who wanted to save in the 21–40% of their income, after learning about the ‘50-30-20’ guideline for needs, short-term wants and longer-term saving. Importantly, nobody finished the session wanting not to save at all.

Student learnings

When asked what their take-home messages were from the workshop, they said:

“Be smart with your money” “Don’t get giddy when you receive your paycheck and spend it all at once!” “Differentiate your needs from your wants” “Think before you spend”

Liaba Mohammad, student prefect, commented, saying:

“I would like to take a brief moment to thank you all for your amazing workshop session today… I thoroughly enjoyed the session. Keep up the wonderful work!”

Staff comments

Katherine Gibson, deputy head of the school, said:

“It’s really important, particularly for Year 10. the power that they have over making that money and controlling money, You could see they felt that they’d gained some power by having that knowledge about financial literacy”

Your thoughts

Write to us with your thoughts and ideas at info@ftflic.com